Excel Expense Report Template

An Expense Report is an organized way for businesses and their employees to track and report their expenses for business-related trips and events. The expense report is usually a printed form or a spreadsheet that is filled out and kept for accounting and tax purposes. Because of this, it is especially important to track any expenses that are tax deductible.

For a quick solution, instead of making your own expense report in Excel or Google Sheets, download and use one of our free Expense Report Templates below. Easily customize the spreadsheet by adding your company information and other details, then share the file with your employees.

Important Note for Employers: When your employees use a travel expense report, they should also submit copies of receipts along with the report so you can keep adequate records for tax purposes. We've included the note "Don't forget to attach receipts" in these spreadsheets to help serve as a reminder.

Travel Expense Report Template

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Description

Report your travel expenses, especially those that are tax deductible, with a simple and easy-to-use spreadsheet. This report template includes separate columns for common types of expenses. It also includes a table for recording detailed itemized expenses, such as a break-down of your meals or transportation expenses.

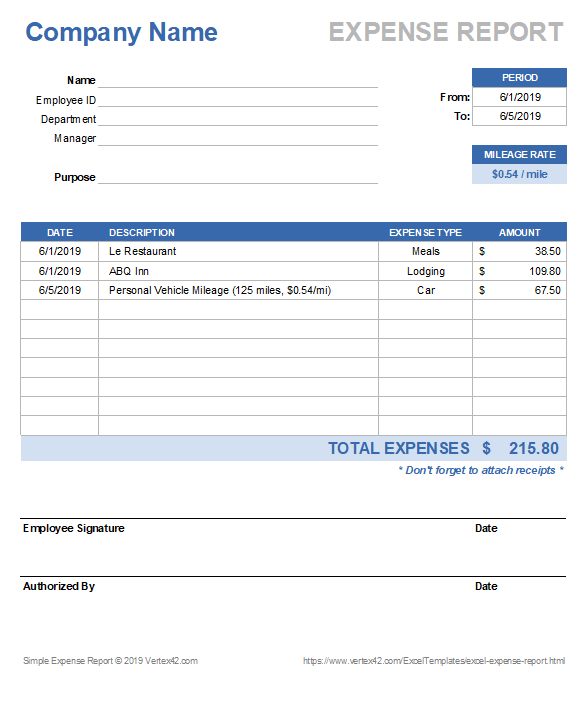

Simple Expense Report Template

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

Description

The Simple Expense Report template uses one column for all expense types. The expense type can be selected from a drop-down that is easy to customize. There is also a designated place to specify the rate for mileage reimbursement.

For a blank, printable expense form that you can fill out by hand, simply remove the sample data and fill in the information you want printed.

Update 5/7/2020: I've added a new worksheet to this version of the expense report that lets you mark specific expenses "to be reimbursed" in case you use both a company card as well as personal money. Place an "x" in this column (or check the box in the Google Sheets version) if you want the amount to be added to the "Amount to Reimburse" total.

What business travel expenses are tax deductible?

Some of the most common tax deductible travel expenses include: flights, car rentals, mileage, uber rides, lodging, meals, tips, dry cleaning and laundry. We've based the expense types in our templates on these common expenses. For an official and detailed list that includes explanations and examples, we highly recommend visiting the Business Travel Expenses page on IRS.gov: https://www.irs.gov/taxtopics/tc511)

Other Helpful Expense Report Templates

Our Reimbursement Form template is great for general employee expense reimbursements (for non-travel expenses). The Business Mileage Tracking Log lets you keep track of daily mileage for record keeping and reporting. The Weekly Expense Report template provides a way to include more details and more expense categories.

Disclaimer: The information on this page is for general education and not to be used as personal financial or tax advice. If you have questions about taxes or proper reporting procedures for travel expenses, please consult a certified professional.