Snowflaking has surfaced as a new popular term related to debt reduction. I would like to take some time to explain what this means, and how you can add "snowflakes" using the Debt Reduction Calculator.

Snowflaking is basically just a new term for an old concept: Making frequent, small, one-time extra payments towards your debt.

These debt "snowflakes" are normally little things like paying an extra $6 towards your debt instead of eating out for lunch one day. Basically, all the little things that you would normally do to SAVE a little at a time can be applied to paying your DEBT a little at a time. For the extremely motivated, it may even be using your birthday money, although that might be a little sad.

I'm not sure who originally coined the phrase, but the article Snowflaking - A Primer is a popular reference. If you search on Google for "debt snowflake" you can find many many articles offering suggestions for ways to save (I mean pay off debt) a little at a time.

I want to point out, though, that snowflaking does not replace the snowball principle. Snowflaking can be done in addition to using a debt snowball. The snowball effect is the principle of devoting a specific amount of money every month to paying down your debts, while a debt snowflake is a one-time extra payment.

How do I add Debt Snowflakes in the Debt Reduction Calculator?

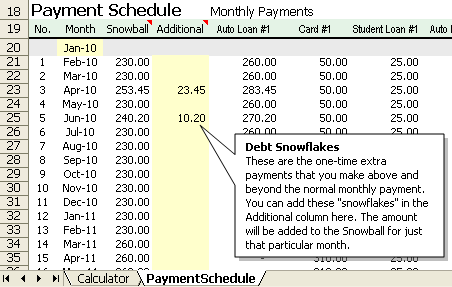

Now that you hopefully know what snowflaking is, let me show you how this is done using the Debt Reduction Calculator. I recently updated the spreadsheet to include this "snowflake" terminology, although the ability to do this has been available for a while now. You'll see in the screenshot below, that extra monthly payments can be applied above and beyond the normal snowball amount by using the Additional column in the PaymentSchedule worksheet.

The screenshot shows that in April I paid an extra $23.45 and in June I paid an extra $10.20. The specific debt that the snowflake is applied to (the Auto Loan #1 in this case) is based on the strategy I chose, which happened to be lowest-balance first.

How Do I Apply the Snowflake Strategy?

Snowflakes that come from extra income are simple to apply. Maybe you got $20 for watching your sister's kids, $10 from a friend that owed you money, $15 from a sale you made on eBay, $250 from a garage sale, etc. The sooner you apply it to your debt, the better, to reduce the temptation to spend it. It is easy these days to make online credit card payments, so you might want to make the payment immediately after the deposit shows up in your bank account.

Snowflakes that come from budget cuts are a little more tricky. You can't just say, "Oh, I didn't buy that big screen TV, so now I've got a $1500 snowflake". Snowflakes that come from not spending should probably only be applied after each budget cycle. For example, if you budgeted $50 for eating out during the month, but spent only $40, then you've got a $10 snowflake. However, if you budget $60 a month for clothing, and only spent $30 one month, it wouldn't be a snowflake if it meant that next month you had to spend $90.

Snowflaking is a psychological thing which some people have even called "fun", so keep an index card in your wallet or purse to keep track of all the times you make these little snowflake decisions. That way, even if you can't apply the snowflake until you've run your monthly budget, you can have little moments of satisfaction and triumph throughout the month.

References:

- Snowflaking - A Primer at paidtwice.com

Comments

I’m one of those that finds snowflaking fun – addicting even. This article is a great overview of the topic! Glad I ran across it.

Great article! Nice example of ‘every little bit counts” Thank you!

That is a very intriguing approach. It is intriguing to believe how much farther we could be in giving off our liability if we directed all those little snowflakes that we’ve been disregarding for years!

Regards,

Jessey Ellen

this is grate job for unknown excel people

So how do you allocate which specific debt the snoball payment was applied to using the debt reduction calculator?

Look at the Payment schedule to see how much is applied to each debt. You may be able to set up automated payments for a while, but when you get close to paying off the current target, you’ll want to go back to manual mode and make the extra payment based on your current budget. Note that the calculator makes only estimates of the actual payments. So, you should update the balances occasionally to get things back on track.

I’ve been doing snowflaking for a while and didn’t even know it. I do the avalanche snowball since it is the most practical but but when balances get low I like to bombard them with extra payments just to wipe them out even if they are a lower interest rate. Great fun if you have the extra money.

Is there a way to indicate that I paid extra on a specific debt?

Not on a specific debt (other than the snowball target) … you’d need to rebalance (update the main table based on current balances).