Cash Flow Statement Template

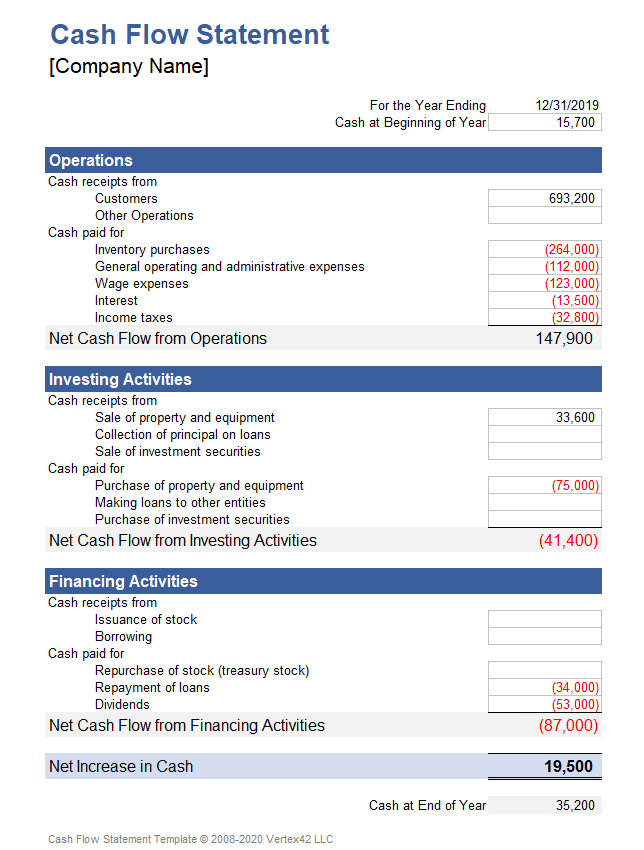

The Cash Flow Statement, or Statement of Cash Flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). By "cash" we mean both physical currency and money in a checking account. The cash flow statement is a standard financial statement used along with the balance sheet and income statement. The statement usually breaks down the cash flow into three categories including Operating, Investing and Financing activities. A simplified and less formal statement might only show cash in and cash out along with the beginning and ending cash for each period.

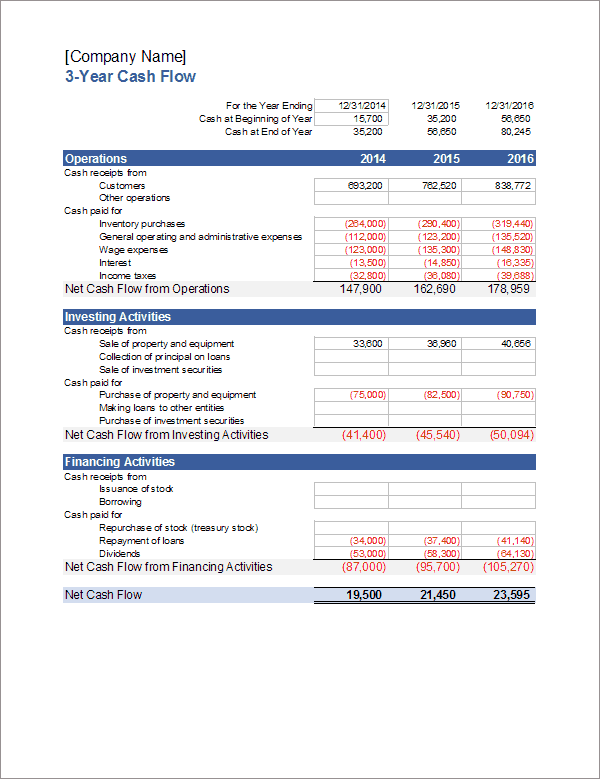

To perform a cash flow analysis, you can compare the cash flow statement over multiple months or years. You can also use the cash flow analysis to prepare an estimate or plan for future cash flows (i.e. a cash flow budget). This is important because cash flow is about timing - making sure you have money on hand when you need it to pay expenses, buy inventory and other assets, and pay your employees.

A cash flow analysis is not the same as the business budget or profit and loss projection which are based on the Income Statement. However, for a small uncomplicated business operating mainly with cash instead of credit accounts, there may seem to be little difference.

Cash Flow Statement Template

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Other Versions

Description

This cash flow statement was designed for the small-business owner looking for an example of how to format a statement of cash flows. The categories can be customized to suit your company's needs. If you don't want to separate the "cash receipts from" and the "cash paid for" then you can just delete the rows containing those labels and reorder the cash flow item descriptions as needed.

The spreadsheet contains two worksheets for year-to-year and month-to-month cash flow analysis or cash flow projections.

Cash Flow Statement Essentials

Operating Activities

Operating activities make up the day-to-day business, like selling products, purchasing inventory, paying wages, and paying operating expenses. Perhaps the most important line of the cash flow statement is the Net Cash Flow from Operations. This section of the statement is associated with the Current Assets and Current Liabilities sections of the Balance Sheet, as well as the Revenue and Expenses section of the Income Statement.

Investing Activities

Investing activities include buying and selling assets like property and equipment, lending money to others and collecting the principal, and buying/selling investment securities. This section of the statement is associated with the Long-Term Assets section of the balance sheet.

Financing Activities

Financing activities include borrowing from creditors and repaying loans, issuing and repurchasing stock, and collecting money from owners/investors, and payment of cash dividends. This section of the statement is associated with the Long-Term Liabilities and Owners'/Stockholders' Equity from the Balance Sheet.

I'm not going to try to explain how to prepare or analyze the cash flow statement other than to say that if you have the records of all the cash transactions, then the preparation can be done using the simple method of categorizing the receipts and payments into the three categories listed above. The indirect method can be used to create the statement of cash flows from the information in the balance sheet and income statement, but I'll leave that explanation for the textbooks. For more information, see the references below.

References:

- Financial Accounting: Reporting and Analysis by M.A. Diamond, E. K. Slice, and J.D. Slice., 2000.

- Cash Flow Statement at wikipedia.org