Balance Transfer Calculator

A balance transfer is a method some people use to pay off their credit card debts more quickly. The idea is to transfer the balance of a high interest rate card to a new card with a much lower rate, then aggressively pay off the new card. Many cards offer a 0% interest period for 6-15 months, but after the introductory period is over, the regular interest rate may end up being higher than your original card. There may also be balance transfer fees (like 3% of the transferred balance).

So, how do I figure out if a balance transfer is a good idea? There are more factors to consider than just the math, but the following calculator can at least help with the math. It compares paying off the original card vs. the balance transfer and estimates the amount saved.

Balance Transfer Calculator

for ExcelDownload

⤓ ExcelLicense: Personal Use

(not for distribution or resale)

Author: Jon Wittwer

Description

This spreadsheet was designed to evaluate the benefit of using a credit card balance transfer as a way to pay off a credit card faster. The basic idea is to transfer the balance of a card to a new card that has an initial 0% interest period so that more of your initial payments can go towards paying down principal instead of interest.

Credit card interest is accrued daily or based on an average daily balance, but this spreadsheet estimates interest payments by assuming a constant interest rate and a constant daily balance for each period. The interest is calculated by multiplying the balance by the nominal annual rate divided by 12. This provides a good estimate, but the results will not match your credit card statements exactly.

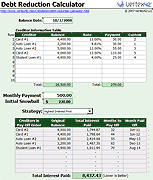

Multiple Cards: If you are considering transferring the balance from multiple cards with different interest rates, then add the balances together and enter the amount in the Current Balance field in this spreadsheet. You can still use this calculator to evaluate the Balance Transfer, but use the debt reduction calculator to evaluate the payoff of the original set of cards.

Update 9/24/2019: I have added the option to enter a non-zero introductory rate. Also created a version for Google Sheets.

Disclaimer: I have not personally done a credit card balance transfer. The information on this page is based on research and math. This spreadsheet and the information on this page is for illustrative and educational purposes only. Results are only estimates. The results may not apply to your unique financial situation. You should seek the advice of qualified professionals regarding financial decisions.

Important Considerations

- A balance transfer can affect your credit score. Applications for new cards and loans may affect your credit score (especially multiple credit card applications in a short period of time). Your score is also affected by available credit and utilization ratios.

- Missing or late payments may cancel the 0% introductory offer on the new card, so MAKE PAYMENTS ON TIME and DO NOT MISS PAYMENTS.

- Make sure to read the fine print on your credit card offer so that you understand all the conditions that affect the interest rate.

- STOP using your old credit card. Do not use the balance transfer as an excuse to max out your old card. That defeats the entire purpose of using a balance transfer as a debt reduction strategy.

- Canceling a credit card may hurt your credit score. One reason is that it lowers your total available credit which in turn increases your debt utilization ratio. Also, if it's an old card, canceling it may lower the average age of your accounts.

- Note: I do not endorse and do not have any specific recommendations for any particular credit card company. Make sure to read all fine print when considering balance transfer offers.

Balance Transfers and Debt Snowballs

A balance transfer is one of the techniques you can consider using to lower the interest rates on your debts. You can also try contacting creditors directly to negotiate lower rates on existing cards. If you have multiple debts, you can use these techniques along with a debt snowball calculator.

After a balance transfer, you may still have multiple debts, so the question becomes "Which debts do I pay off first?" If you are using the strategy of paying off the highest rate debts first (the "Avalanche" approach), it becomes a complex optimization problem to determine the ideal payment plan if you have a credit card with a 0% introductory period that later rises to a nominal rate higher than your other debts.

So, a general rule of thumb is that if the nominal rate of the card is significantly higher than your other debts, pay it off first even if there is a 0% introductory period. If the nominal rate is equal to or lower than your other debts, then apply your snowball first to the debt with the highest rate. Make minimum payments on the 0% card to avoid fees or a cancellation of the 0% offer.

My free debt reduction calculator does not currently have the option of specifying a 0% introductory period. However, I am working on a new extended version with that feature. If you want to try that worksheet, you'll need to email me after purchasing the extended version.

Related Resources

- What is a Balance Transfer, and Should I Consider Doing One? at NerdWallet.com - This provides some useful general advice and a simple example.

- BankRate.com - Provides an online calculator that lets you transfer the balance from multiple cards into a single new card.

- CalcXML.com - Hosts a simple online balance transfer calculator that lets you include up to 4 credit cards to transfer to a single new card.