Debt Reduction

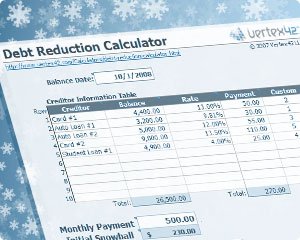

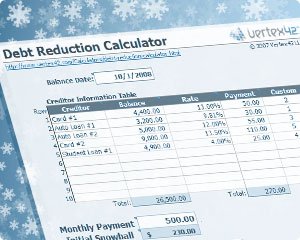

Discover various strategies for reducing debt. Learn about the debt snowball, snowflaking, and various strategies for paying off your mortgage early. In addition to these articles, Vertex42 has created many different spreadsheet-based tools to help you. The most popular free calculators to help you analyze your debts and mortgage are our Debt Reduction Calculator and Home Mortgage Calculator.

Taking a break from Excel tutorials, this article compares paying off credit card debt to investing. Take an in-depth look at interest rates, liquidity risk, limited return, risk of principal loss, and tax efficiency. Perhaps debt payoff is really my best investment.

Vertex42’s free Debt Reduction Calculator helps you create a plan for paying off your debts using a variety of different strategies. What strategies have worked best for you?

This article explains how to use the Debt Reduction Calculator to calculate the Monthly Payment that will help you reach your goal of paying off your debt in X number of years or months.

Find out the inside scoop on biweekly mortgage payment plans, how to choose a service provider, and some of the fees to watch for.

If you are interested in getting completely out of debt, paying off your mortgage may be the largest hurdle. Here is a list of strategies for paying off your mortgage early. Most of these strategies can be evaluated using the [...]

Snowflaking has surfaced as a new popular term related to debt reduction. I would like to take some time to explain what this means, and how you can add “snowflakes” using the Debt Reduction Calculator. Snowflaking is basically just a [...]