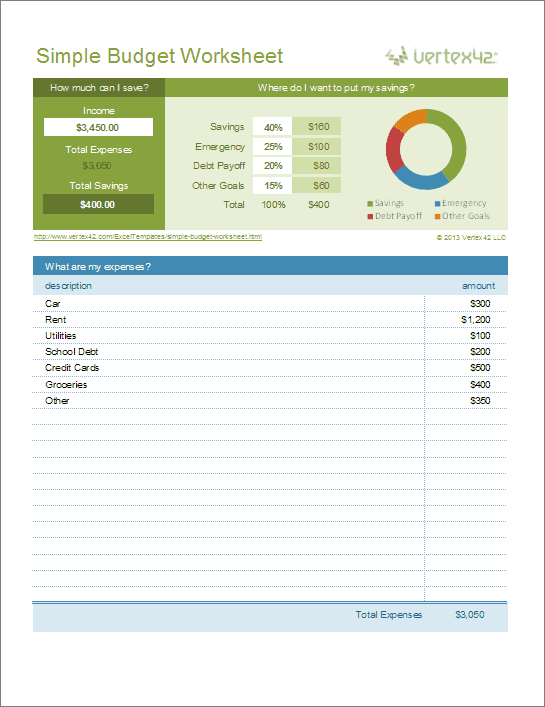

Simple Budget Worksheet

This new Simple Budget Worksheet gives you an extremely easy way to start budgeting. The main purpose of the spreadsheet is to help you calculate how much you can put towards savings each month. For something a little more detailed, try our budget planner or weekly budget spreadsheets.

The simple budget worksheet uses a graph to show you how your savings can be divided up. It lists 4 different places to put your savings: Savings, Emergency, Debt Payoff, Other Goals. It also lets you choose what percentage of your total savings to devote to each category. You can change the labels for the savings categories to suit your particular financial strategy.

Simple Budget Template

for Excel and Google SheetsDownload

⤓ Excel (.xlsx)Other Versions

License: Private Use (not for distribution or resale)

Author: Jon Wittwer

Description

This worksheet helps you create a very simple budget. Begin by entering your monthly (or weekly or biweekly) income. Then list your bills and other expenses for that pay period. The total savings is calculated by subtracting the total expenses from your income.

A simple budget is a great place to start if you are trying to get a handle on your finances. How you allocate your savings is up to you. But, if you need some general guidance, a good place to start is to first save $1000 to be used as your initial rainy-day fund. That amount is usually enough to handle unexpected variable expenses, but not enough to handle big emergencies. So, your next goal could be to begin building up your emergency fund and starting a snowball to pay off credit card debt (see our debt reduction calculator).