Rental Billing Statement Template

Do you have a tenant who does not always pay rent on time? A professional way to send reminders is using a rental billing statement. With this template you can track all payments, invoices, and late fees charged to your tenants. Then, print a copy of the statement to give to your tenant if they miss or are late on a payment.

You can also use the billing statement if your renter requests a receipt or if there is a question about what is owed. Sending a rental statement to your renter is a simple way to communicate all fees charged, rents due, and payments received, so make sure to keep it accurate and up-to-date.

Rental Billing Statement

for ExcelDownload

⤓ Excel (.xlsx)License: Private Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

This template has been customized from our original billing statement template specifically for landlords needing a simple way to bill their tenants. It provides a simple way to keep track of rents due, fees charged, and payments received.

It includes a place in the header to list the property associated with each tenant's account. For multiple properties, you can either save a separate file or make a copy of the worksheet to keep everything within the same workbook.

When sending the rental statement, you may not want to show a record of all prior payments and amounts due. For example, if you routinely send a statement at the end of each month, you may just want to show the transactions for the current month (and enter a Balance Forward as the first line in the activity table). You could still save a copy of the worksheet to be used as your own record of all transactions.

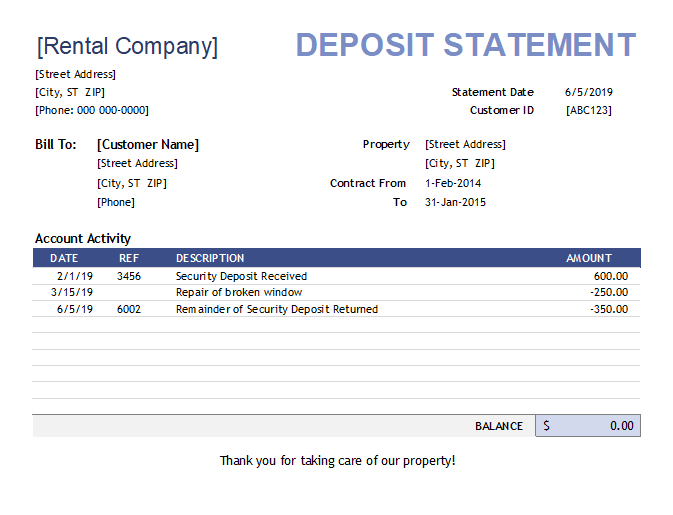

How to Track the Security Deposit

Update 6/5/2019: I have added a new Deposit Statement worksheet for tracking the renter's security deposit. Most of the information in the statement is updated automatically after you edit the Statement worksheet.

As shown in the screenshot above, the first line in the table should be the date, check number, and amount of the initial security deposit. Later, if the landlord is required to pay for repairs caused by the renter (like a broken window), you can enter a row to indicate the date, description, and amount subtracted from the security deposit.

Note: You would not deduct the repair as a business expense if you are subtracting it from the security deposit instead.

Using the Remittance Section

The Remittance section at the bottom of the worksheet is not absolutely necessary, but it does help the tenant to see the Due Date and Balance Due and it gives them a way to help ensure that you process their payment accurately.

Update 6/5/2019: I have added conditional formatting to hide the remittance section when there is no balance due. It does this by changing the font to white.

If you insert more rows into the table, the remittance could end up overlapping two pages and that wouldn't work well. Instead of listing multiple months of transactions, consider using a Balance Forward and only listing the most recent transactions. Or, add enough rows so that the entire remittance section shows up on a separate page.